How many credit cards do you have in your wallet? Statistics show that on average Canadians have 3 credit cards. Initially, the credit card was a pure banking product whereas today it can carry a multitude of benefits. Unfortunately, most people are unsure about benefits or protection provided with their credit cards, despite paying for them. We hope that through a better understanding, your credit card insurance protection you may find opportunities to save money by eliminating "overlapping" or "excessive" protection.

Benefits and perks offered by your credit cards

There are three main categories of benefits or services attached to credit cards (though there are surely some additional benefits that vary between the cards):

- Banking benefits/services: e.g. interest rates, interest-free grace period etc.

- Rewards program: e.g. rewards points / miles, cash back etc.

- Protection/insurance: e.g. flight delay insurance, rental car insurance etc.

Incidentally, insurance is the largest area of credit card benefits and is comprised of multiple topics that provide protection in a number of life situations:

- Purchase protection

- Auto protection

- Travel protection

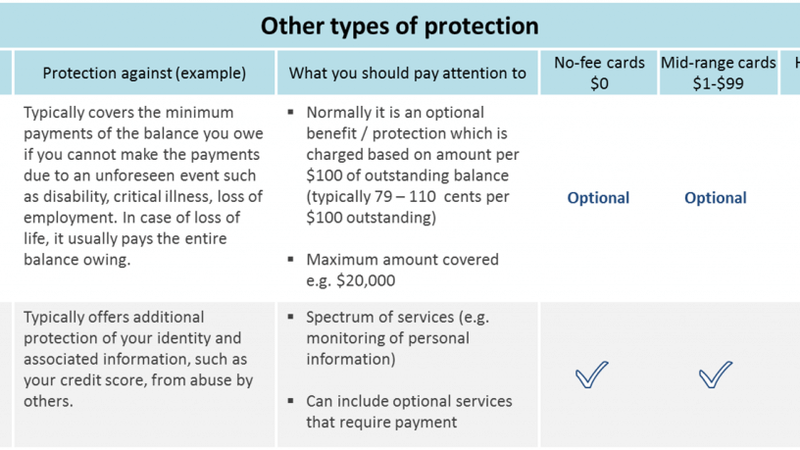

- Other types of protection

The general rule is simple – the more expensive your card, the more benefits and protection it offers. However, it may vary from card to card, which is why we’ll compare three categories of cards:

- No-fee cards, which offer limited, yet valuable, benefits and protection

- Mid-range cards (annual fee under $99), which offer a good balance of price and benefits / protection offered

- High-end cards, (annual fee over $99), which offer an extensive range of benefits and protection.

Digging into insurance benefits on your credit cards

The following table provides an overview of typical protection benefits that may come with your credit card, compared across the three categories of cards. It also explains, in simple language what does this benefit or protection means to you, and what the important features are for each benefit.

For a more detailed picture of benefits specific for your credit card check our Credit Card Navigator Tool.