Why it is better to choose a credit card from an insurance perspective rather than a rewards.

When choosing a credit card, for personal or business use, the most popular parameter that people consider is probably rewards. According to research conducted by our partner, InsurEye, this feature’s value is strongly over-exaggerated. There is another segment of credit card features which is worth much more than consumers think — insurance.

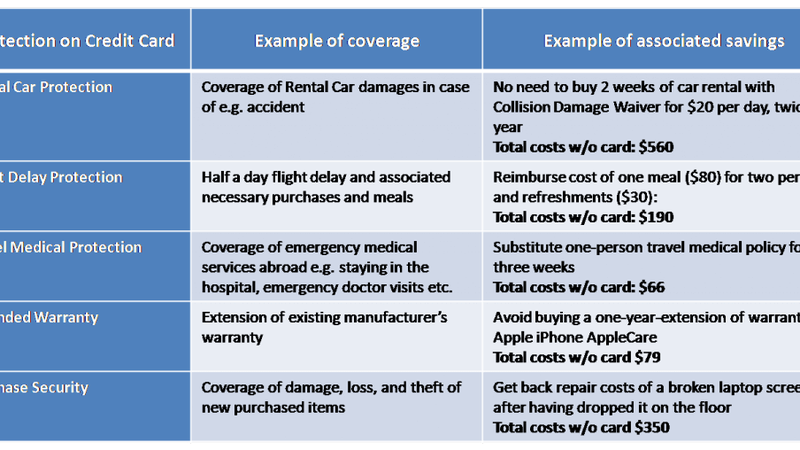

Everybody knows credit cards come equipped with some kind of insurance coverage, however very few people are fully aware of the insurance perks details and benefits that come along with their credit cards. Below are some specific, potential real-life examples for the types of cases covered by credit card insurance and associated expenditures:

If all of the above scenarios occurred the total saving amount is: $1,250. While it is unlikely that all of these things would happen to the same person, the potential benefits of proper credit card insurance coverage are evident. Of course, there are many other things not covered above, such as Trip Interruption and Cancellation, Baggage Loss and Delay, Hotel burglary, Common Carrier Accident (life and disability insurance in case you were involved in a vehicle accident). Adding these features could plausibly increase the potential savings. Credit Card Navigator at InsuranceHotline.com allows you easily discover details of insurance protection on your current credit cards as well as identifying the right card to add to your wallet.

On the other side, let’s look at the value of different rewards programs:

According to credit card research from MoneySense the top rewards cards such as Capital One Aspire World MasterCard or BMO World Elite MasterCard offer a value between $350 and $500 for traveller’s cards. In the case of cash back cards the average value is considered to be approximately $400 for the MBNA SmartCash Platinum Plus MasterCard and approximately $350 for the Capital One Aspire World MasterCard which came out as top cards in this category.

Given these findings, active travellers are likely to benefit more from the travel insurance benefits of credit cards than the rewards components. Luckuly there is no need to sacrifice one benefit for the other as there are plenty of credit cards which offer both insurance protection and rewards. You can explore these features and compare your available options through our free Credit Card Navigator tool. If you are looking to save money in the long run, we suggest that when considering your next credit card, give some preference to insurance protection before rewards.

Source: These insights and Credit Card Navigator at InsuranceHotline.com are offered you by InsurEye. InsurEye Inc. is a Canadian leader in independent, innovative online services to help consumers better understand and manage their insurance.