As the province navigates its way through the pandemic, more people get vaccinated, and businesses re-open, life is starting to tip-toe towards something resembling normalcy.

People are beginning to drive more, and some are even returning to their daily commute. For these individuals, the good news is insurance rates in the province continue to remain stable for the time being.

In Ontario, every insurance company must have changes to their auto insurance rates approved by the Financial Services Regulatory Authority of Ontario (FSRA). Once approved, FSRA publishes the rate changes they’ve green-lighted to proceed.

Ontario auto insurance rate-filing decisions in Q3 2021

In Q3 2021 (July, August, and September), Ontario auto insurance rate changes amounted to a weighted average of –0.3%.

| Insurance Provider | Approved Rate Change (%) | For Policies with Effective Renewal Dates Beginning: |

|---|

| Sonnet Insurance Company | 0.96% | July 17, 2021 |

| Echelon Insurance | 0% | August 15, 2021 |

| Intact Insurance Company | -1.90% | September 30, 2021 |

Ontario auto insurance rate-filing decisions in Q2 2021

In Q2 2021 (April, May, and June), Ontario auto insurance rate changes amounted to a weighted average of 0.0%, but three insurance companies did lower their rates a bit.

| Insurance Provider | Approved Rate Change (%) | For Policies with Effective Renewal Dates Beginning: |

|---|

| Dominion of Canada General Insurance Company (The) | 0% | 1-Apr-21 |

| Belair Insurance Company Inc. | 0% | 5-Apr-21 |

| Personal Insurance Company (The) | 0% | 23-Apr-21 |

| Certas Direct Insurance Company | 0% | 23-Apr-21 |

| Farm Mutual Reinsurance Plan Inc. (on behalf of Ontario Mutuals) | 0% | 1-May-21 |

| Economical Mutual Insurance Company | -0.11% | 1-May-21 |

| Wawanesa Mutual Insurance Company (The) | -0.04% | 1-May-21 |

| Verassure Insurance Company | -0.02% | 13-May-21 |

| TD General Insurance Company | 0% | 22-May-21 |

| Security National Insurance Company | 0% | 22-May-21 |

These approved rate changes reflect the average the insurance provider’s policyholders may see upon renewal. However, these are averages, and some policyholders will see their premiums change more or less than what’s listed, or not at all.

Ontario auto insurance rate-filing decisions in Q1 2021

In comparison, the results for Q1 (January, February, and March) are similar in that both quarters saw a weighted average change in prices of 0.0%. However, in Q1, five insurance companies lowered their prices and one increased them:

| Insurance Provider | Approved Rate Change | Renewal Effective Date |

|---|

| Aviva General Insurance Company | 0.00% | January 1, 2021 |

| Gore Mutual Insurance Company | -4.96% | January 1, 2021 |

| Heartland Farm Mutual Inc. | -0.42% | January 1, 2021 |

| Belair Insurance Company Inc. | -1.85% | January 15, 2021 |

| Federated Insurance Company of Canada | 0.00% | January 15, 2021 |

| TD General Insurance Company | 0.00% | January 15, 2021 |

| Security National Insurance Company | 0.00% | January 15, 2021 |

| Primmum Insurance Company | 0.00% | January 15, 2021 |

| Portage la Prairie Mutual Insurance Company (The) | -0.03% | February 1, 2021 |

| Co-operators General Insurance Company | 0.34% | February 7, 2021 |

| Commonwell Mutual Insurance Group (The) | -0.10% | March 1, 2021 |

| Allstate Insurance Company of Canada | 0.00% | March 15, 2021 |

| Pembridge Insurance Company | 0.00% | March 15, 2021 |

Ontario auto insurance rates in 2020

When the pandemic hit, auto insurance companies filed emergency applications to delay, change, or withdraw pre-pandemic approvals that involved raising prices. Insurance providers also filed emergency applications to be able to offer clients rebates and rate reductions.

As a result, FSRA says it approved 83 rate applications between March 17, 2020, and December 31, 2020, of which 81 were for an average change of 0% or less.

A brief history of Ontario auto insurance rates before the pandemic

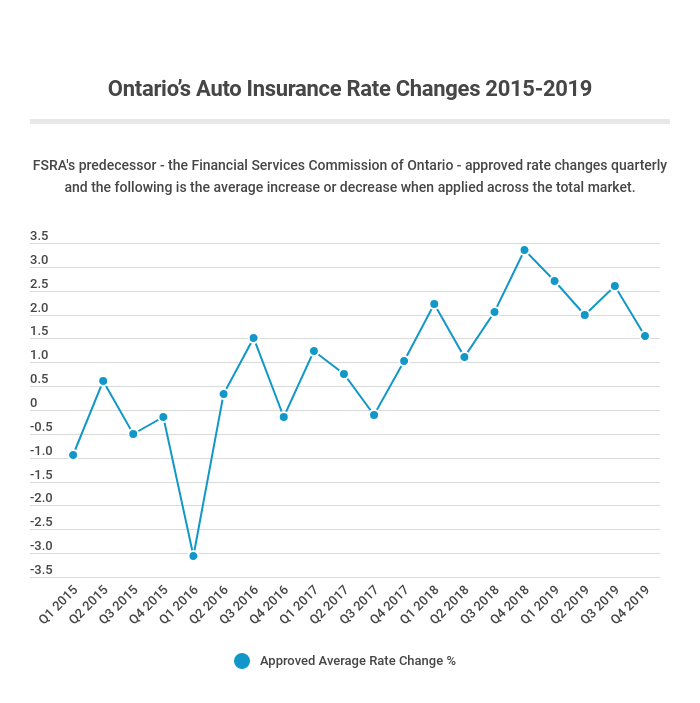

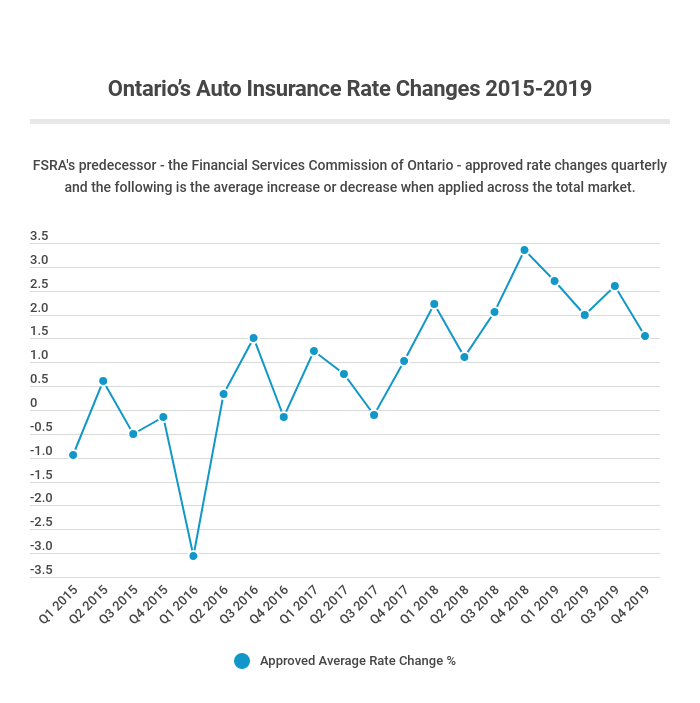

Before 2020, FSRA’s predecessor, the Financial Services Commission of Ontario, would highlight the average increase or decrease in approved rates when applied across the total insurance market in the province. The chart below gives you an idea of how auto insurance rate changes trended between 2015 and 2019.

Ontario insurance companies are competing for your business

Ontario car insurance rates change all the time, so the best rate you found last year or a couple of years ago may not be the lowest price you find today. To make sure you're getting the best rate possible, make it a habit to shop around. With InsuranceHotline.com, you can compare quotes online and for free.

Find the Best Car Insurance Rates

Compare car insurance quotes from 50+ providers in a single search. Start saving money today on the premiums you pay.