Alberta Home Insurance Premium Calculator

Use our calculator to get Alberta home insurance estimates from 50+ insurance companies in one go.

Jump straight to:

- What is a home insurance calculator?

- How to use InsuranceHotline.com’s Alberta home insurance calculator

- Benefits of using a calculator to calculate your Alberta home insurance premium

- Easily calculate your Alberta home insurance premium

- What factors directly affect your home insurance premiums in Alberta?

- Frequently asked questions about calculating your Alberta home insurance

What is a home insurance calculator?

A home insurance calculator is a tool to help you assess how much the premium will be for coverage on your Alberta home. Calculators can be a helpful first step on your insurance-buying journey — but only if they're accurate.

InsuranceHotline.com's calculator will display accurate quotes from multiple home insurance companies.

Comparing quotes with a home insurance calculator can help you save hundreds, even thousands, of dollars in a world of rising insurance costs. Keep reading to learn how to get the best results from our Alberta home insurance calculator.

We've got hundreds of 5 star reviews

2,247 reviews on TrustPilot. See some of the reviews here.

Fran

Curtis

Robert Clarkson

Vincenzina Perri

Keith

Dev

Georgia

Shirley Munro

Hoang Tran

Alnoor

Michael Benninger

Gene

D on

Robert

Remonia Thompson

Rich

Luis

How to use InsuranceHotline.com’s

Alberta home insurance calculator

Enter Postal Code

Start with your postal code!

Enter Your Information

Answer a few quick questions about yourself and your home.

Compare Your Quotes

Compare home insurance coverage and quotes from 50+ insurance companies.

Benefits of using a calculator to calculate your Alberta home insurance premium

Finding the cheapest Alberta home insurance premiums with a calculator has many advantages. For example:

- It's free. Buying a home is one of the most expensive purchases you'll ever make. Cut down on your monthly housing expenses by getting a competitive rate on home insurance. Our Alberta home insurance calculator is free and provides up-to-date insurance quotes to help you save money.

- Quick and easy. It only takes a few minutes and a few bits of information to get a sense of what your home insurance premium rates will be.

- Get home insurance rates from multiple sources. You have the peace of mind that you’re comparing estimates from not just one but a variety of providers when you use InsuranceHotline.com's Alberta home insurance calculator.

- Compare and find the cheapest estimate. Within seconds, we'll show you accurate quotes from multiple providers. Comparing will help narrow down providers.

- Use it anytime and anywhere. The best part of our Alberta home insurance calculator is that you can access it online from anywhere, 24/7. We're always open, making your home insurance comparison shopping easy and convenient.

You can save hundreds of dollars by comparing quotes on our digital marketplace, which includes over 50 of Canada's top insurance providers. It's free to use with no hidden obligation on your part.

It only takes a few steps to find cheap Alberta home insurance:

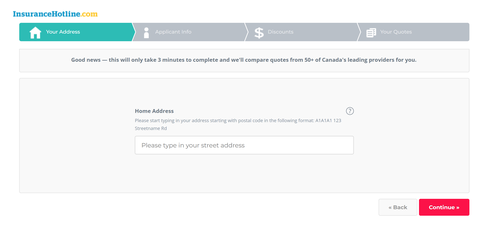

1. Tell us your address

Enter the property’s address. To make this even easier, our system will offer to autocomplete the field once you type in the first few characters.

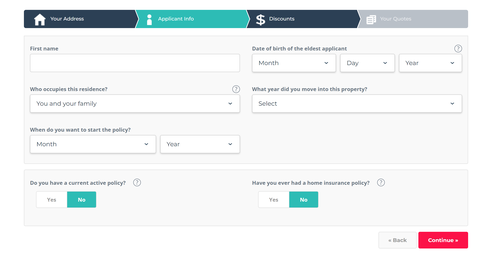

2. Tell us who lives on the property

Tell us your first name, date of birth of the eldest applicant, who occupies the residence, when you moved into it and when you would like your policy to start.

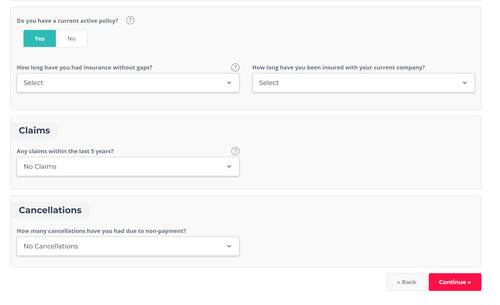

3. Tell us about your past and current insurance policies

If you have an active home insurance policy, you can specify how long you’ve had insurance, how long you’ve been with your current provider, the number of claims in the last five years and the number of cancellations due to non-payment. For past home insurance policies only, you just get to specify the number of claims in the last five years and the number of cancellations due to non-payment.

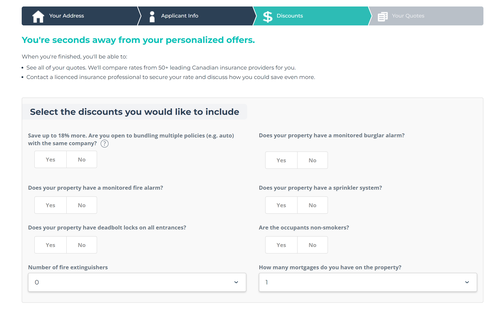

4. Select your discounts

If you’d like to get a discount on your policy, be sure to answer a few questions about your property, occupants and insurance preferences. This includes letting us know whether you’re open to bundling your home insurance with other policies, such as your auto insurance policy. Other possible discounts include:

- Security discount: Do you have monitored fire and burglar alarms and deadbolt locks on all entrances?

- Fire prevention discount: How many fire extinguishers do you have? Do you have a sprinkler system? Do non-smokers occupy the home?

- No-mortgage discount: Owning a property in full will lower your rate.

5. Get your rates

Provide your email address and get your free home insurance quotes from 50+ providers in our partner network. The lowest quote is shown first and includes information about the insurer or brokerage and their contact information.

What factors directly affect your home insurance premiums in Alberta?

Alberta insurance companies leave nothing to chance when assessing your home insurance and its cost. They are looking at risk factors to determine the likelihood you will or will not make claims. The higher the possibility, the higher the risk they consider you, the higher your premium will be. The opposite is true if an insurer believes you are less likely to make a claim.

Some of the factors that directly affect your home insurance premiums in Alberta include:

- Where you live. Location is an important factor for Alberta home insurance companies. For instance, if you live in a high-crime area where theft and vandalism are problems, you will be assessed as a higher risk to insure and pay higher premiums.

- Heat source. The methods you use to heat your home can significantly impact the price of your Alberta home insurance premiums, as some are considered more hazardous than others.

- Radiators are considered safe by insurers, as they rely on hot water rather than combustible substances to distribute the heat throughout your home.

- Wood stoves are at the other end of the spectrum. If improperly maintained, they can cause carbon monoxide poisoning and are a common source of house fires.

- Type of electrical distribution. Older homes with knob and tube wiring are prone to electrical issues and fires, so insurers would take a considerable risk by insuring them. New homes with up-to-code electrical systems are less of a fire hazard and generally have fewer fire claims.

- Pipes and plumbing. Older pipes and plumbing can pose problems, too. Rust, constant back-ups, and flooding are all more likely. Alberta home insurance providers will take note of these risk factors and price your premiums accordingly.

- Age of roof. Leaks, even small ones, can lead to significant water damage. New roofs are designed to ensure the best possible water run-off. The materials used for tiles are light and durable, and the introduction of fascia and soffits means the roof over your head is properly ventilated. Older roofs will eventually deteriorate and may not fully protect you from weather events such as rainfall, snow, hail and wind. The roof is one of the most critical components of your home's infrastructure, and insurance companies may offer discounts for roofs that are 20 years old or younger.

- Primary use of your home. You must inform your insurance provider if you are considering renting out part of your home, operating an Airbnb, or running a business out of your home. Using your home for purposes other than as your primary dwelling will increase your premium.

- Your claims history. Insurance companies want to know how likely you are to make a claim. Being low-risk in this area will keep costs down. But if you have a claims history, they will price your premium accordingly.

- Proximity to fire hydrant and fire station. Every second is critical when there's a house fire. Proximity to a fire hydrant or station can mitigate fire damage and lead to a smaller claim, which results in a lower annual premium.

- Alarm system. All security systems can help deter thieves and vandals from damaging your home. Installing one can help you get a discount from Alberta home insurance providers.

- Rebuilding costs. The need to rebuild or renovate your home can occur after a catastrophic disaster. Using customized and higher-end materials in your home will increase the replacement cost and lead to higher premiums.

Frequently asked questions about calculating your Alberta home insurance

How much does home insurance in Alberta cost on average?

The average cost for home insurance in Alberta in 2022 is $2,339, according to the RATESDOTCA Insuramap. In Ontario, the average premium was $1,487. That's a difference of 36%.

Alberta's high insurance rates are tied to its location and bad luck regarding weather-related and climate change issues. For example, Ontario has yet to experience flooding and forest fires on the scale that Alberta has undergone.

There are ways to mitigate damage and costs. Residents of Alberta can consider:

- Regularly cleaning pipes and gutters

- Using impact-resistant materials on roofs

- Avoid planting trees that are especially flammable

- Getting water coverage included in insurance policies

Where and how can I calculate my estimated home insurance premium?

You can calculate your Alberta home insurance premiums with InsuranceHotline.com's home insurance calculator. It's easy to use, free and will only take a few minutes to get the cheapest rates from more than 50 of the top providers in Canada.

How can I lower my home insurance premium?

You can lower your home insurance premium by:

Bundling: Insurance companies are likely to offer cheaper rates to customers who bundle other insurance policies, such as auto and life, with their home insurance.

Increasing deductibles: De-risk yourself by taking on a greater share of risk by offering to pay a higher deductible than required. It will reduce your insurance premium.

Paying a lump sum: Paying once a month is an administrative burden for insurance companies. Paying your premium in full once a year lessens that burden, and the savings are passed on to you.

Choosing group insurance: Some organizations, such as alumni groups or unions, offer their members discounts on home insurance.

Being claims-free: Insurance companies give preferred rates to customers who don't file claims.

Installing a security system: Protecting your home with a good security and smoke detection system can reduce the risk of damage and costs to your home.

What is a home insurance deductible, and how do I choose one?

A home insurance deductible is the amount you agree to pay out-of-pocket before an insurance company pays a claim. You can talk to your provider about how much or little you want to pay upfront. The more you agree to pay, the less of a risk you are and the more you can save on your Alberta home insurance policy.