Home Insurance Premium Calculator

Calculate your home insurance estimates from 50+ insurance companies in one go.

What is a home insurance calculator?

InsuranceHotline.com’s home insurance calculator is an online tool that lets you view home insurance rates from 50+ leading providers in Canada.

You can access the home insurance calculator from just about anywhere on our website, including this page. Just pick your insurance type – homeowner, condo or tenant – then enter your postal code, and you’ll access the calculator. From there, all you need to do is put in a few details about yourself and access your very own customized quotes.

Why use a home insurance calculator?

If you’re unsure about using our home insurance calculator, here are a few reasons that might convince you:

- It’s fast and easy. Using our home insurance calculator to access free quotes takes no more than three minutes. The best part is that you can get started right this second. Here’s a link to access our home insurance calculator now.

- You get real quotes. By using our home insurance calculator, you can access quotes from 50+ leading insurers in the country. These are not mere estimates either – these are real quotes, with real prices, from real insurers you can contact right away, if you’re interested.

- Get the cheapest rates available. By pulling multiple home insurance quotes at once, you get to compare rates instantly, making it easy to immediately spot good deals. What’s even better is that our insurance partners all compete to offer you the cheapest rate available.

- Do it anywhere, anytime. You can access our home insurance calculator from any device – whether it’s your laptop, tablet or smartphone – and you can do it at any time. In the middle of the night, if you prefer.

- It’s free. You don’t have to pay a cent for using our home insurance calculator, nor are you forced to accept any of our quotes. If you don’t like the rates on offer, you’re free to close the browser and look elsewhere.

We've got hundreds of 5 star reviews

2,247 reviews on TrustPilot. See some of the reviews here.

Fran

Curtis

Robert Clarkson

Vincenzina Perri

Keith

Dev

Georgia

Shirley Munro

Hoang Tran

Alnoor

Michael Benninger

Gene

D on

Robert

Remonia Thompson

Rich

Luis

How to get the cheapest home insurance quote

Get multiple home insurance quotes in the time it takes to get just one

1. Enter Postal Code

Start with your postal code!

2. Enter Your Information

Answer a few quick questions about yourself and your home.

3. Compare Your Quotes

Compare home insurance coverage and quotes from 50+ insurance companies.

To make use of our home insurance calculator, all you need are an operational computing device, such as a desktop, laptop, tablet or smartphone, your fingers and thumbs and basic reading comprehension.

With those in your possession, here are the exact steps you need to take once you've entered your postal code:

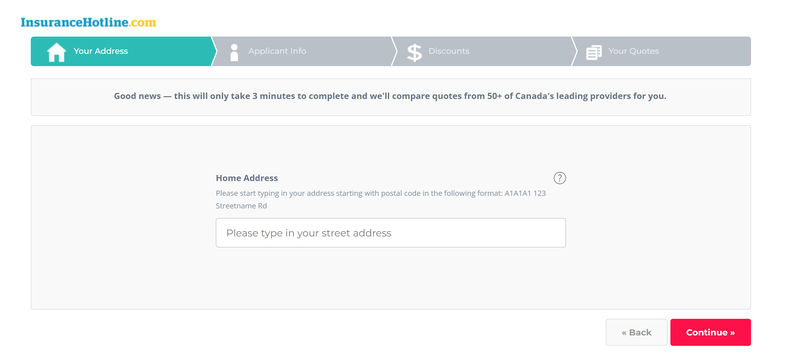

1. Tell us your address

Enter the property’s address. To make this even easier, our system will offer to autocomplete the field once you type in the first few characters.

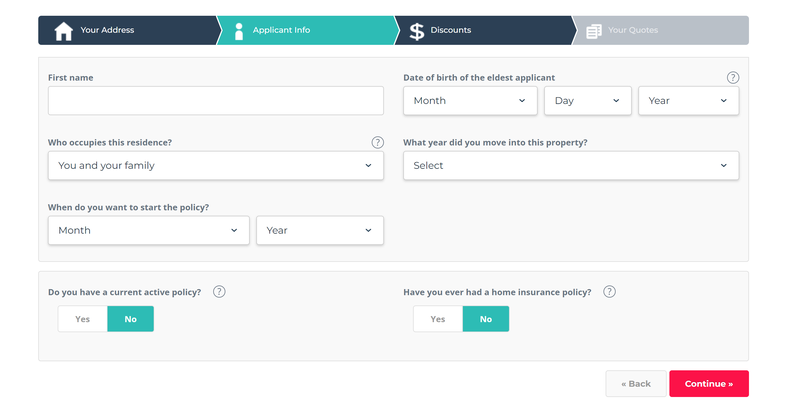

2. Tell us who lives on the property

Tell us your first name, date of birth of the eldest applicant, who occupies the residence, when you moved into it and when you would like your policy to start.

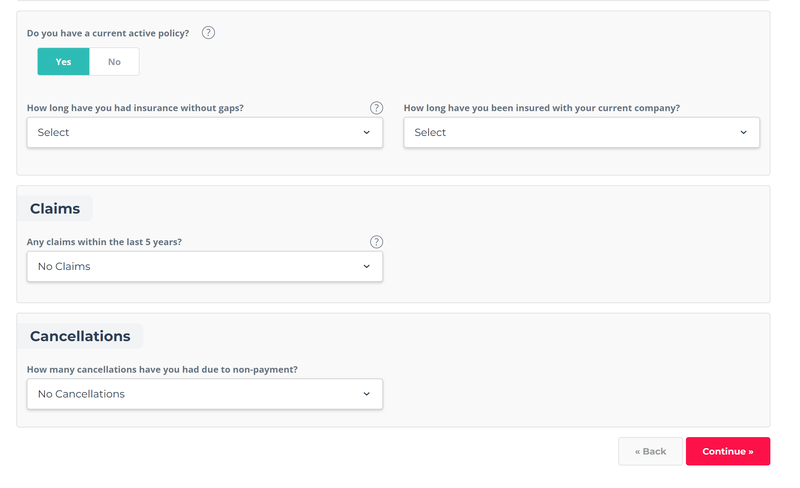

3. Tell us about your past and current insurance policies

If you have an active home insurance policy, you can specify how long you’ve had insurance, how long you’ve been with your current provider, the number of claims in the last five years and the number of cancellations due to non-payment. For past home insurance policies only, you just get to specify the number of claims in the last five years and the number of cancellations due to non-payment.

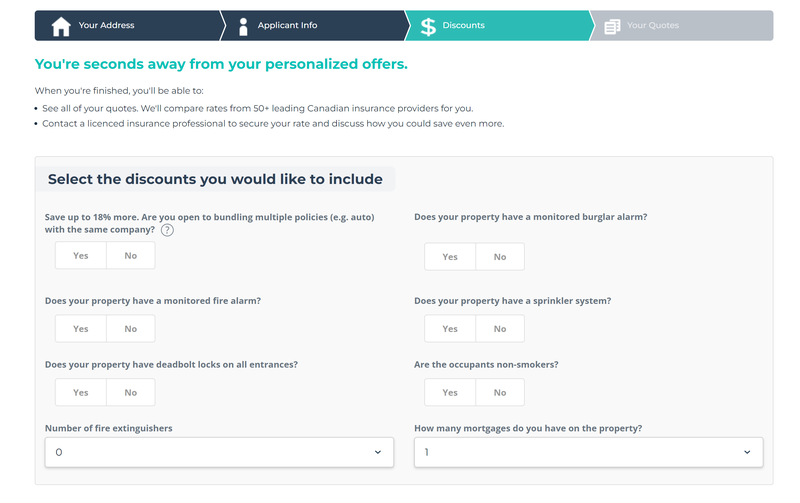

4. Select your discounts

If you’d like to get a discount on your policy, be sure to answer a few questions about your property, occupants and insurance preferences. This includes letting us know whether you’re open to bundling your home insurance with other policies, such as your auto insurance policy.

5. Get your rates

Provide your email address and get your free home insurance quotes from 50+ providers in our partner network.

Despite our best efforts, there are factors affecting your home insurance rates that are beyond our control. However, some of them might be within your control. Here's what they are:

- Your home’s replacement cost: How much your home costs to rebuild from scratch can have a big impact on your insurance premiums. Square footage, number of floors, overall structure as well as material and labour costs all play a role in determining this cost.

- Your home’s condition: The more maintenance concerns a home has, the more likely is to require expensive premiums. If the home is old (built prior to the 1950s), it might have outdated plumbing, such as galvanized steel, and outdated electrical wiring – either knob-and-tube or aluminum – both of which can increase the risks of flooding and fire, respectively. Old roofs and fuel oil tanks can also be a huge risk, especially if they are over 20 years old.

- Your home’s renovations: Renovating your home can raise its value. Be sure to notify your insurer if you happen to make any modifications, so your payout fully covers your home in the event of damage or loss.

- Your home’s location: Your location plays a big role in determining your rates. If an area has high amounts of crime, floods, earthquakes or other perils that can endanger your home, then your rates will be more expensive.

- Your home’s security: Having security measures, such as burglar alarms, can help lower your insurance, especially if you live in a high-crime neighbourhood. That’s because good security is able to prevent break-ins and thefts from occurring altogether, making your life cheaper and safer.

- Your home’s proximity to fire halls and hydrants: Rural homes tend to be further away from fire halls and hydrants than their urban counterparts. This increases their likelihood of suffering severe fire damage, which could make your premiums more expensive.

- Your claims history: The more claims you’ve made in the past, the higher your home insurance premiums will be – and vice versa. We recommend filing a claim only if your home suffers from a major peril, such as fire, for instance. If it’s a smaller issue, like a puddle from a minor pipe leak, consider addressing the problem yourself to keep your premiums as low as possible. Insurance is not meant for maintenance concerns.

- Your credit score: Having a high credit score can lower your premiums. That’s because people who pay their debts on time are statistically less likely to file a claim.

- Your mortgage: If you have paid off a solid portion of your mortgage, then you may be entitled to an insurance premium discount between 10% and 20%.

Frequently asked questions about calculating your Canadian home insurance

Find answers to all your questions about our home insurance calculator here.

How much is the average home insurance in Canada?

The average cost of home insurance in Canada ranges from about $800 to $2,000 per year. According to the 2022 RATESDOTCA Home Insuramap data, the average annual home insurance premium in Ontario is $1,487, while in Alberta, it is $2,339.

Home insurance rates have seen some significant increases in the last few years. One of the biggest driving factors behind this is climate change, which has led to a higher number of natural disasters, such as floods, tornadoes and wildfires. The increased prevalence of windstorms and severe winter weather has also played a role in increasing the premiums.

Where can I calculate my home insurance?

You can calculate your home insurance here on InsuranceHotline.com by using our home insurance calculator. Just enter a few details about yourself and your property, and you should start seeing results immediately.

Note that since each insurer has their own method for calculating insurance rates, there is no definitive way of determining your specific insurance premium without going through an insurance agency, insurance brokerage or insurance comparison website like ours. Any numbers outside of that, including those from the RATESDOTCA Insuramap, are estimates, not actual premiums.

How can I lower my home insurance premium?

If you’re looking to lower your home insurance premium, there are several steps you can take, including the following:

- Increase your deductible. The higher your deductible, the less you have to pay for your home insurance. That said, you would have to pay more when making claim, so make sure you have the necessary funds saved up in advance.

- Update your home. If your home still has galvanized steel plumbing or knob and tube wiring, then consider updating them to meet modern standards. This will not only improve your safety but significantly reduce your premiums.

- Install a theft alarm system. The more secure your home is, the less likely it is to be robbed or vandalized. This translates into lower premiums.

- Add extra protections to your home. To limit the damage to your home from rainwater, snow and severe weather overall, consider adding safeguards like sump pumps, reinforcing your basement walls and fixing your roof (especially if it’s over 20 years old).

- Bundle multiple policies together. If you own a car, bundle your car insurance with your home insurance under the same insurer. In most cases, this is guaranteed to get you a discount.

- Ask about discounts. It never hurts to ask your provider about potential discounts you might be missing out on. For instance, many insurers offer loyalty discounts to long-time customers. You may get other discounts, depending on your circumstances.

- Stick to annual payments. Processing monthly payments leads to higher administrative costs. This means that annual payments can reduce those costs – savings that your insurer will be happy to pass on to you.

- Don’t over-insure your home. Buy only the coverage your home actually needs and avoid paying for anything else. For instance, if overland flooding is highly unlikely in your area, there is no reason to purchase an add-on for it.

- Compare, compare and compare. Whether you use a quote comparison website like InsuranceHotline.com or just a regular brokerage, don’t cheat yourself out of a great deal – compare quotes from as many insurers as you can. With InsuranceHotline.com, you can compare quotes from over 50 leading insurers in Canada – in just a few minutes (and for free).

What is a home insurance deductible and how can I choose one?

A home insurance deductible is the amount you’re willing to pay out of pocket when filing a claim. This lets you share the risk of insuring your home with your provider. For instance, if your home suffers $4,000 worth of damages, and your deductible is $1,000, then your insurer will cover you for $3,000. The rest will come out of your pocket.

Thus, the higher the deductible, the lower the premiums. On the flipside, this also means higher upfront expenses.

The amount you set for your deductible will depend on how much risk you’re willing to take on and how much you’d like to pay in premiums. While a higher deductible can lead to a premium discount, it may not always be the right course of action, especially if you aren’t prepared to pay out of pocket.

Since insurance premiums are based on your specific circumstances, you should consult with your insurance agent or broker to determine what deductible is right for you.