Ontario Home Insurance Premium Calculator

Calculate your Ontario home insurance estimates from 50+ insurance companies in one go.

What is a home insurance calculator?

A home insurance calculator – accessed from just about anywhere on InsuranceHotline.com – is an online tool that lets you view home insurance rates from more than 50 top providers in Ontario.

To access our Ontario home insurance calculator, just pick your insurance type at the top of the page – either homeowner, condo or tenant – and enter your postal code. After that, you’ll be directed to the calculator. All you need to do from there is type in or select a few details about yourself and your property and then access your very own customized quotes.

If you’re wondering why you’d want to use InsuranceHotline.com’s Ontario home insurance calculator, here are a few reasons to consider:

- It takes very little time. You can access free quotes through our Ontario home insurance calculator in less than three minutes. If you don't believe us,try our home insurance calculator for yourself.

- The rate you get are real. When using our Ontario home insurance calculator, you gain access to quotes from over 50 leading insurers in the province. These are not just estimates either – these are actual quotes, from real insurers, whom you can contact right away, if you so choose.

- Get the cheapest rates available. Our Ontario home insurance calculator lets you compare rates instantly, in one place, making it easy to pinpoint a good deal. What’s even better is that our insurance partners all compete to offer you the cheapest rate available.

- Do it anywhere, anytime. You can use our Ontario home insurance calculator from any computing device – from your desktop to your smartphone or tablet – and you can do so at any time, even in the middle of the night.

- It’s free. It costs nothing to use the calculator. We also don’t ask you for any payment information. So, if you don’t like the quotes on offer, you’re free to close the browser and walk away – no strings attached.

We've got hundreds of 5 star reviews

2,247 reviews on TrustPilot. See some of the reviews here.

Fran

Curtis

Robert Clarkson

Vincenzina Perri

Keith

Dev

Georgia

Shirley Munro

Hoang Tran

Alnoor

Michael Benninger

Gene

D on

Robert

Remonia Thompson

Rich

Luis

How to get the cheapest Ontario home insurance quote

Get multiple home insurance quotes in the time it takes to get just one

1. Enter Postal Code

Start with your postal code!

2. Enter Your Information

Answer a few quick questions about yourself and your home.

3. Compare Your Quotes

Compare home insurance coverage and quotes from 50+ insurance companies.

The Ontario home insurance calculator is literally a click away from this very page. If you can read this sentence, then you can access the calculator.

With that in mind, here are the exact steps you need to take:

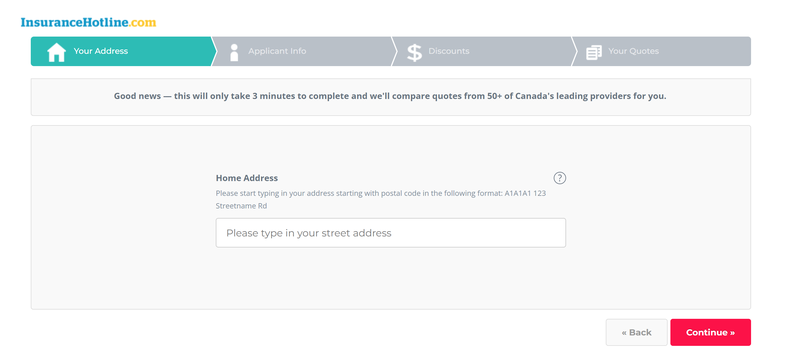

1. Provide your address

Select whether you’re looking to insure a home, condo or a rental property and enter its address. Our system will offer to autocomplete the field once you type in the first few characters.

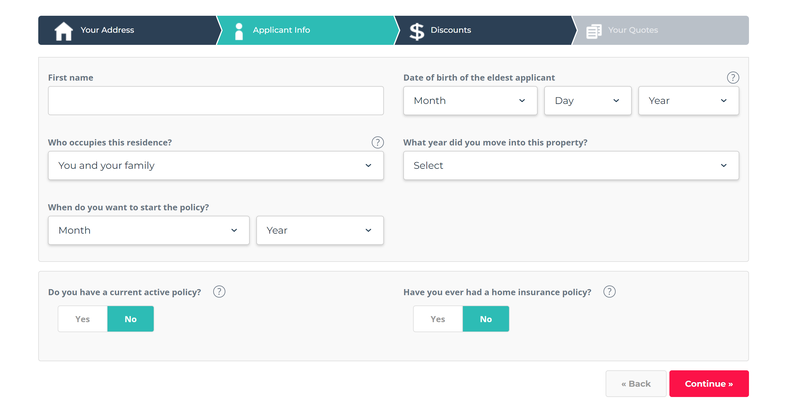

2. Tell us about yourself and your property

Tell us your first name, date of birth of the eldest applicant, who occupies the residence, when you moved into it and when you would like your policy to start.

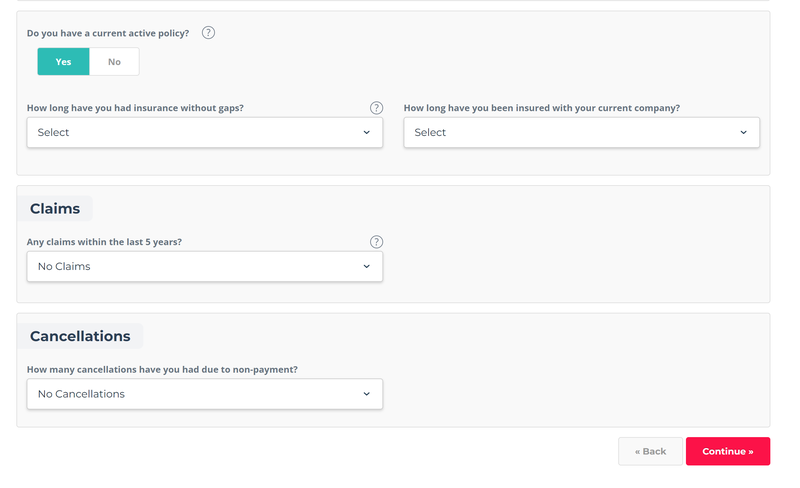

3. Tell us about your past and current insurance policies

If you have a home insurance policy right now, you can specify how long you’ve had insurance, how long you’ve been with your current provider, the number of claims in the last five years and the number of cancellations due to non-payment.

For past home insurance policies, you only need to specify the number of claims in the last five years and the number of cancellations due to non-payment.

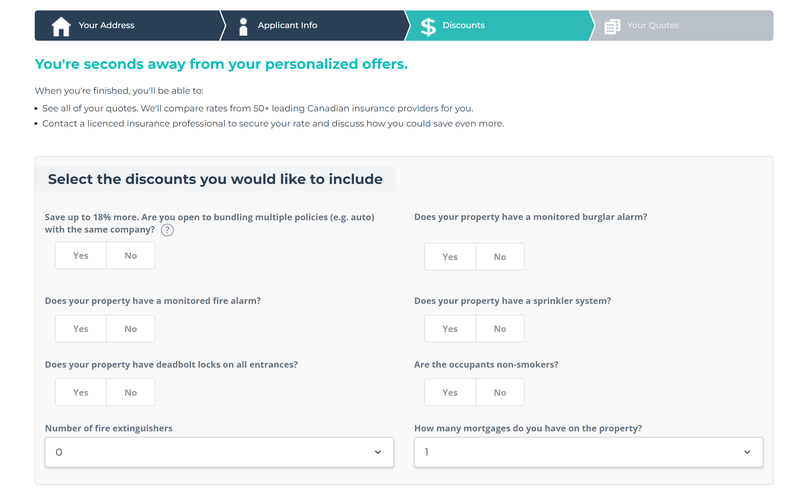

4. Choose your discounts

If you’d like to get discounts on your home insurance policy, take the time to answer a few questions about your property, occupants and insurance preferences. This includes letting us know if you’re open to bundling your home insurance with other policies, such as your car insurance.

5. Get your rates

Give us your email address and get your free home insurance quotes from more that 50 insurers in our partner network.

Your home insurance premiums are based largely on your individual factors and circumstances. This means that even though we aim to provide the cheapest rates available, certain things are beyond our control. Here are some of them:

Home-related factors:

- Overall condition: The older the home, the more likely it is to be in a subpar condition, especially by insurance standards. Homes built prior to the 1950s, for instance, have outdated plumbing and electrical wiring, which have a high likelihood of causing flooding or fire. Old roofs and fuel oil tanks can also be a huge risk, especially if they are over 20 years old.

- Rebuilding costs: How much your home costs to rebuild from gound up will influence your insurance premiums. Square footage, number of floors, overall structure as well as material and labour costs all play a role in determining this cost.

- Renovations: Certain home renovations can raise the value of your home. This applies only if your insurer already knows about the renovations. That said, it’s worth notifying them if you want your payout to be higher in the event of damage or loss.

- Location: The location of your home can play a significant role in your premiums being high or low. If an area has huge amounts of crime, flooding, earthquakes and/or other perils, then your rates will also be high. While Ontario doesn’t have the most expensive home insurance premiums in Canada, they have gone up due to increases in risk factors like crime, extreme weather and wildfires.

- Security: Putting security measures, such as burglar alarms and other anti-theft systems, can help lower your insurance, especially if you live in a high-crime neighbourhood. That’s because good security systems can prevent break-ins and thefts from occurring in the first place.

- Proximity to fire halls and hydrants: Having a home that’s close to fire halls and hydrants means lower likelihood of total loss in the event of fire. This is mostly a problem for rural homes, as they tend to be more secluded than urban homes.

Homeowner-related factors:

- Claims history: Filing more claims leads to higher insurance premiums. Consider reducing the number of risk factors threatening your home (some of which we already mentioned above) and avoid filing a claim when you can address the issue yourself. For instance, a minor pipe leak is probably not a big enough issue to warrant contacting your insurer. Insurance is for major events only. Not for maintenance.

- Credit score: If your credit score is in good order, you can get your insurer to perform a check, without impacting the score itself. People with high credit scores are statistically less likely to file claims, which means they get cheaper premiums. Note that doing a credit score check won’t result in a premium increase, since insurers are not allowed to do that in Ontario.

- Mortgage: Paying off a solid portion of your mortgage can get you an insurance premium discount of 10% to 20%.

Frequently asked questions about Ontario home insurance

How can I find the cheapest home insurance quote in Ontario?

Finding the cheapest home insurance quote in Ontario begins with shopping around to find the best coverage at the lowest rate. It also relies on the homeowner customizing their policy so that they’re only paying for the coverage they need and nothing more. Once they’ve tailored the policy, there are other steps they can take to reduce their premium such as bundling their policies, increasing their deductible, installing alarms and keeping the home in good repair. A policyholder with no claims history may also be able to secure savings.

How much is home insurance in Ontario?

In 2022, the average home insurance premium in Ontario was $1,487, according to RATESDOTCA’s annual Insuramap survey. In general, premiums vary depending on several factors, including location. Homes located near water often pay the most expensive home insurance costs due to the perceived risk of damage from flood.

For example, in 2022, a RATESDOTCA survey of provincial home insurance costs found that residents in LaSalle, Ontario near Windsor paid the most in the province: $2,411. This represented a 15% increase from 2021.

Across Ontario, home insurance premiums went up about 10% between 2021 and 2022. In addition to the risk from flooding and incidents of severe weather, residents in more rural areas tend to pay more for home insurance coverage. This can be attributed to in large part to location, including distance from a fire hydrant. When it’s difficult for emergency services to put out a fire, the homeowner should expect to pay more for coverage.

Do I need to update my Ontario home insurance provider if I am running a short-term rental on Airbnb or Vrbo?

Yes. It’s crucial that homeowners who are renting out their homes inform their insurance provider and secure a landlord policy.

It will cover them for property damage from tenants in the rental unit. It will also provide legal liability for injuries or property damage as well as loss of rental income if the tenants vacate the unit due to a covered event. Insurance providers may deny a claim if damage is found to have been caused by a tenant and they were unaware that the home was being rented out – regardless of whether it was rented out on a short-term or long-term basis.

How can I file a home insurance claim in Ontario?

When a home is damaged by a covered peril, we recommend the homeowner immediately contact the insurance provider to acknowledge the damage. Most providers publish emergency contact resources on their websites.

Homeowners should also consider taking steps ahead of time that will make filing a claim as simple as possible. For example, keeping an inventory of belongings provides the homeowner with an overview of what they own and how badly it has been damaged. There are many apps that help homeowners make a comprehensive inventory.