Canadian Car Insurance Guides

Learn more about car insurance in Canada and increase your chances of securing the cheapest premium.

See all our car insurance guides now

Everything you need to know about car insurance in Canada.

Postal code and your auto insurance rate

Where you live can have a significant impact on your car insurance rate especially if you live in a high-risk neighbourhood.

Fire and theft deductible endorsements

Ontario and Alberta both have auto insurance endorsements that let you apply a deductible to a loss caused by fire or theft.

Age, gender and car insurance

Did you know that your age and gender cab both play a role in determining your auto insurance rate?

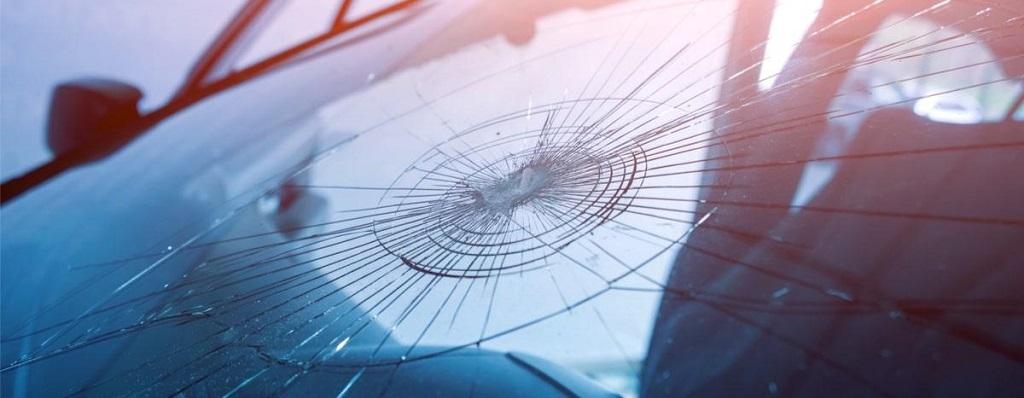

Limited glass coverage endorsement

Damage to a cars windshield is more common than you think. Do you think your auto insurance has you covered?

Limited waiver of depreciation

If your car is stolen or deemed a total loss, you can replace it with a car of comparable value, regardless of depreciation. Do you have the right coverage?

Loss of use endorsements

If you were to suddenly lose your car, do you have a plan B for how to get around without it? Your insurance might help.

Suspension and reinstatement of coverage

If youre not going to use your car for a prolonged period of time, you can suspend your insurance policy and reactivate it later.

Marriage and auto insurance premiums

Did you know that being married can earn you a break on car insurance in certain provinces?

Emergency roadside assistance

Find out how much emergency roadside assistance endorsements to your auto insurance can cover when it comes to towing costs.

Overnight parking and car insurance

Your commute and car insurance

Car insurance for newcomers in Canada

Family protection coverage

Ontario driver’s license types and car insurance

Winter tire insurance discount

Student car insurance

Electric vehicle insurance

Sports car insurance

Car insurance for G2 drivers